KYC REGULATION BY CBN: This Policy Change Will Only Make It More Difficult For People At The BOP To Access Financial Service – Engr. Bally

The “Know Your Customers” KYC regulations directing banks to obtain information on customers’ social media handles for identification by the Central Bank of Nigeria(CBN) under the acting Governor, Mr Folashodun Shonubi, (Customer Due Diligence) comes as a shock to me as we are already grappling with financial exclusion.

This policy change will only exacerbate the problem and make it more difficult for people at the Bottom of the Pyramid (BOP) to access financial services.

Firstly, a significant number of Nigerians are financially excluded, particularly those living in rural areas. They lack access to commercial banks due to poor infrastructure and high transportation costs. Additionally, many are not tech-savvy and cannot afford smartphones or the high cost of data in Nigeria. This new policy will further complicate financial inclusion efforts and disenfranchise more people.

Secondly, this new policy will leave many Nigerians vulnerable to financial fraud. Social media handles to reveal a customer’s true identity and make it easier for fraudsters to carry out fraudulent activities. While BVN, NIN, and TIN provide an extra layer of security, social media handles break down that layer and increase the risk of bank fraud. Ultimately, the people most affected will be those at the BOP.

The Central Bank of Nigeria(CBN) holds the obligation of justifying any fetter on people’s freedom of privacy online, as enshrined under section 37 of the Nigerian Constitution 1999, as amended and human rights treaties to which the country is a state party, any restrictions on these rights must be applied strictly so that the rights of customers to such privilege are not put in imperilment by any financial institution under any regulations.

I agree with the thought of SERAP that; ” Obtaining the details of customers’ social media handles or addresses would unduly interfere with the rights to freedom of expression and privacy. It would also be disproportionate to any purported legitimate aim that the CBN seeks to achieve and that obtaining information on customers’ social media handles or addresses as means of identification is, therefore, more intrusive than necessary.”

It is the responsibility of the Central Bank of Nigeria to contribute to the advancement of respect for the rule of law and human rights protection in the furlough of its statutory functions, and not undermine these fundamental legal injunctions and norms.

Ostensibly, the purported unavoidable prerequisite of the CBN KYC regulations would stymie the fundamental principles of Nigerians from freely exerting their human rights online. It is irrefutable that if such private information is obtained, it may also be misused for heinous purposes by unscrupulous elements, who already have unrestricted access to customers’ bank details via their banks.

Lastly, banks already collect NIN, BVN, and TIN as KYC. It is logical for them to utilize these data sources to get more information about their customers. Including social media handles as a requirement will only confuse and make the process more complicated.

The CBN needs to focus on financial inclusion rather than implementing policies that create more hurdles for Nigerians. The use of financial credit modelling experts may prove to be a more effective approach. It is essential to engage stakeholders and the public in addressing these challenges to make financial inclusion a reality for all.

This policy change will only widen the gap and increase the already significant financial exclusion rate in Nigeria. It is imperative to educate the public on the potential problems that may arise from this social media handle as a KYC requirement and advocate for more innovative and inclusive solutions for a better financial future.

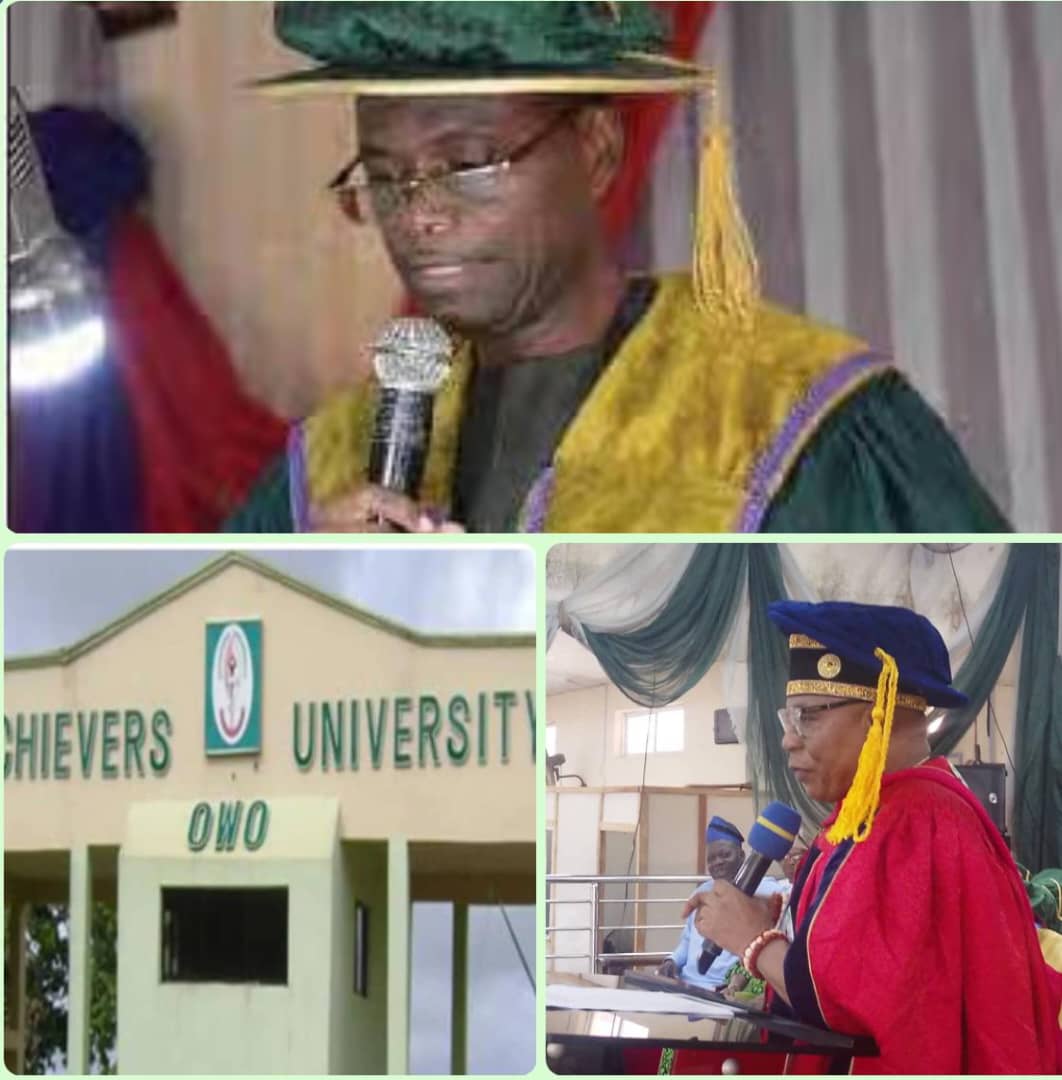

Engr. Ayotunde Akinola Bally

Financial Inclusion Advocate, Fintech Expert and CEO of Arvo Finance