President Bola Ahmed Tinubu on Tuesday (yesterday) inaugurated the Presidential Committee on Fiscal Policy and Tax Reforms at the Presidential Villa.

Members of the Committee included the Ondo State Commissioner for Finance, Mr Wale Akinterinwa and Miss Orire Agbaje, is a 400-level Economics student of the University of Ibadan; SUNSHINETRUTH can report

Mr Akinterinwa, is also the Chairman of the 36 State Commissioners of Finance, while Miss Agbaje is also the President of the Nigerian Universities Tax Club.

Miss Orire Agbaje, is a 400-level Economics student of the University of Ibadan. She is the President of the Nigerian Universities Tax Club and has now been offered a seat at the table. She’s now a member of the just inaugurated Presidential Committee on Fiscal Policy and Tax Reforms.

The committee comprising tax experts and key private sector stakeholders is saddled with the responsibility of harmonising taxes in the country to boost revenue.

However, one interesting thing that caught the eyes of Nigerians is the inclusion of Miss Orire Agbaje, a 400-level Economics student at the University of Ibadan, in the committee.

Speaking on his latest appointment, Akinterinwa said “Today (tuesday) the Presidential committee on Fiscal Policy and Tax Reforms under the Chairmanship of Mr Taiwo Oyedele was formally inaugurated by Mr President at the state house.

“I am grateful to Mr President for nominating me as a member of this committee made up of distinguished personalities across the various sectors of the Nations economy,” said Mr Wale Akinterinwa, Obdo State Commissioner for Finance.

Miss Agbaje has a strong interest in tax policy and will be working closely with Taiwo Oyedele, a former Fiscal Policy Partner and Africa Tax Leader at PriceWaterhouseCoopers (PwC), who chairs the committee.

Agbaje is one of the few talented young Nigerians selected for the 2023 Nigeria Higher Education Foundation (NHEF) Scholars Programme.

In her LinkedIn details, Agbaje described her passion for “crunching digits” as the reason she considered studying accounting and taxation.

“My love for crunching digits made me take up Accounting (ICAN) and further exposed me to Corporate finance and taxation which I’m learning on,” she wrote.

The committee has been mandated by the President to address the challenges faced by Nigeria in the areas of fiscal governance, tax reforms, and growth facilitation.

STATE HOUSE PRESS RELEASE

PRESIDENT TINUBU VOWS TO END NIGERIA’S OVERRELIANCE ON BORROWING FOR PUBLIC EXPENDITURE

… sets 18% Tax to GDP target in 3 years

President Bola Tinubu on Tuesday in Abuja expressed his resolute commitment to break the vicious cycle of overreliance on borrowing for public spending, and the resulting burden of debt servicing it places on the management of Nigeria’s limited government revenues.

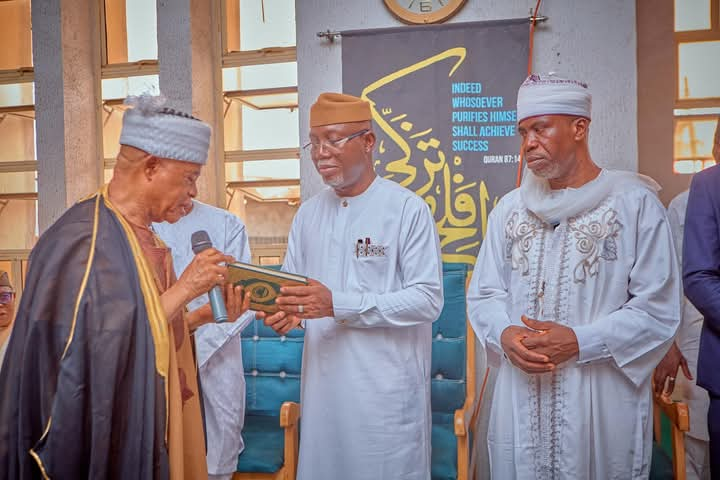

Inaugurating the Presidential Committee on Fiscal Policy and Tax Reforms, chaired by Mr. Taiwo Oyedele, the President charged the committee to improve the country’s revenue profile and business environment as the Federal Government moves to achieve an 18% Tax-to-GDP ratio within three years.

The President directed the Committee to achieve its one-year mandate, which is divided into three main areas: fiscal governance, tax reforms, and growth facilitation.

He also directed all government ministries and departments to cooperate fully with the committee towards achieving their mandate.

President Tinubu told the Committee members the significance of their assignment, as his administration carries the burden of expectations from citizens who want their government to make their lives better.

”We cannot blame the people for expecting much from us. To whom much is given, much is expected.

”It is even more so when we campaigned on a promise of a better country anchored on our Renewed Hope Agenda. I have committed myself to use every minute I spend in this office to work to improve the quality of life of our people,” he declared.

Acknowledging Nigeria’s current international standing in the tax sector, the President said the nation is still facing challenges in areas such as ease of tax payment and its Tax-to-GDP ratio, which lags behind even Africa’s Continental average.

“Our aim is to transform the tax system to support sustainable development while achieving a minimum of 18% tax-to-GDP ratio within the next three years.

”Without revenue, government cannot provide adequate social services to the people it is entrusted to serve.

”The Committee, in the first instance, is expected to deliver a schedule of quick reforms that can be implemented within thirty days. Critical reform measures should be recommended within six months, and full implementation will take place within one calendar year,” the President directed.

Recounting the President’s sterling track record on revenue transformation, the Special Adviser to the President on Revenue, Mr. Zacchaeus Adedeji described the committee members, drawn from the public and private sectors, as accomplished individuals from various sectors.

”Mr. President, you have the pedigree when it comes to revenue transformation. You demonstrated this when you were the Governor of Lagos State over 20 years ago,” the Special Adviser said.

Chairman of the Committee, Mr. Taiwo Oyedele pledged the total commitment of members to give their best in the interest of the nation.

“Many of our existing laws are out-dated, hence they require comprehensive updates to achieve full harmonisation to address the multiplicity of taxes, and to remove the burden on the poor and vulnerable while addressing the concerns of all investors, big and small,” he said.

Ajuri Ngelale

Special Adviser to the President

(Media & Publicity)

August 8, 2023