The Nigerian Consumer Credit Corporation (CREDICORP), and Gamma Mobility and Accion Microfinance Bank, have flagged off Queen Rider programme—an initiative designed to empower women through access to credit-backed income-generating assets.

In line with CREDICORP’s policy to support local industries, the tricycles distributed in Akure were assembled by Simba TVS, a leading Nigerian three-wheeler manufacturer with a daily production capacity of over 1,170 vehicles.

This, not only enhances domestic manufacturing but also drives job creation and economic circulation.

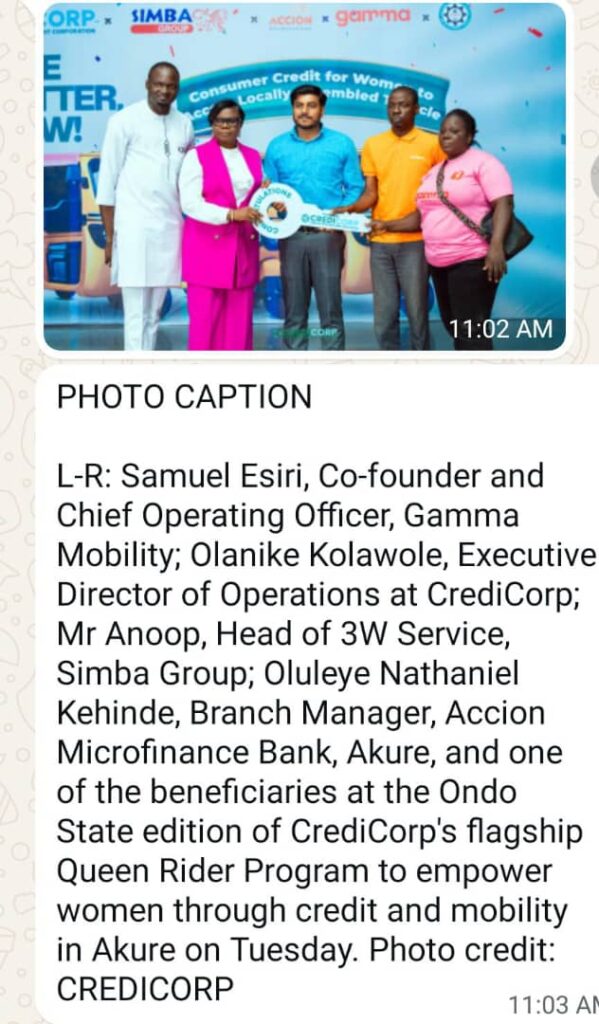

At an event tagged “Credit for Women to Access Locally Assembled Tricycle”, held on Tuesday, July 22, 2025, in Akure, dozens of women receive locally assembled tricycles fully financed under the S.C.A.L.E. scheme—Securing Consumer Access for Local Enterprises—which offers affordable credit for productive tools.

In her address, Mrs. Olanike Kolawole, who is the Executive Director of Operations at CREDICORP noted that the Queen Rider programme targets the empowerment of 3,700 women nationwide, with at least 100 beneficiaries in each state and the Federal Capital Territory.

Acoording to her, through vehicle ownership, the initiative opens doors to commercial transport opportunities, economic self-reliance, and participation in high-yield sectors often inaccessible to women due to traditional credit barriers.

“What we’re building is a pipeline of dignity—where Nigerian women move from survival to stability through credit,” said Mrs. Kolawole.

“The Queen Rider program, which aims to empower 3,700 Nigerian women (at least 100 per state and the FCT), gives beneficiaries ownership of vehicles that can be used for commercial transport—unlocking income opportunities and economic independence, particularly for women often excluded from formal lending and high-yield economic sectors.

“As with previous rollouts, the tricycles distributed in Akure were assembled locally by Simba TVS, one of Nigeria’s leading three-wheelers (keke) assemblers with a production capacity of over 1,170 vehicles daily. This strengthens Nigeria’s industrial base while ensuring that each loan supports local job creation and economic circulation.

“What we’re building is a pipeline of dignity—where Nigerian women move from survival to stability through credit,” said Olanike Kolawole, Executive Director, Operations of CREDICORP.

“These are more than vehicles. They represent access, ownership, and control over one’s economic future—and they’re made in Nigeria, financed in Nigeria, and changing lives across Nigeria.”

“By enabling structured, credit-based access to productive tools, CREDICORP is catalyzing grassroots economic activity—one state at a time. The Queen Rider program is one of several transformative projects under the organization’s broader vision to provide consumer credit to half of Nigeria’s working population by 2030.

The CREDICORP Executive Director informed that the programme is one of several under the Corporation’s broader goal to extend credit access to half of Nigeria’s working population by 2030.

Other ongoing initiatives include YouthCRED, aimed at youth and NYSC members, and C.A.L.M., which focuses on clean energy and CNG adoption—each guided by the core principle of using credit as a catalyst for inclusion, empowerment, and economic transformation.

CREDICORP continues to partner closely with the Central Bank of Nigeria (CBN), licensed financial institutions, and indigenous manufacturers to deliver scalable, inclusive credit solutions nationwide.

Earlier in his welcome address, Mr. Samuel Ezire of Gamma Mobility informed that the Tricycle empowerment is targeted at 100 women in Ondo State and that repayment is on a daily basis for a period of two years after which they would take complete ownership of it.

Speaking on behalf of the beneficiaries, Mrs. Adewole Olabanke appreciated CREDICORP and partners while expressing their commitment to meet up with the repayment agreement.

She noted that the gesture would relieve them of their financial burdens and assured of its maintenance.